Wow, 2020, where do I begin? I’ve been telling clients for about 4 years, “The market is pretty high, this could be the year that we see a correction”—sure didn’t have any idea that it would be a virus that would take us down and then, after a huge correction be back where we started by the end of the year! What a ride! Obviously, none of us predicted that we would spend the better part of a year sequestered at home, living in fear of running out of toilet paper and learning how to sew masks, all in the middle of a heated election year. Since this is the last blog post of 2020 it always feels nice to pause and ponder over the year. So, what did we actually learn from all of this and how can we better next year?

What we learned at my house

At my house we learned how important patience is when we are all at home 24/7 for work, school and leisure without a break from each other.

We learned how to be flexible when normal was no longer the norm.

We learned how to solve problems when the old ways didn’t exist any longer.

We learned how to set up a Zoom meeting, so we could see clients and family, go to school in Google Classroom and send and sign documents electronically.

We learned how important it is to have an Emergency Savings, 3- or 6-months’ worth of living expenses for home and your business.

We learned how to budget our finances and our resources.

And we learned that the most important commodity in the Covid-2020 era is toilet paper! I have to confess that I am not a big believer in buying gold in uncertain times and this crisis proved what I have believed all along, you can’t eat gold and you certainly can’t flush it down the toilet.

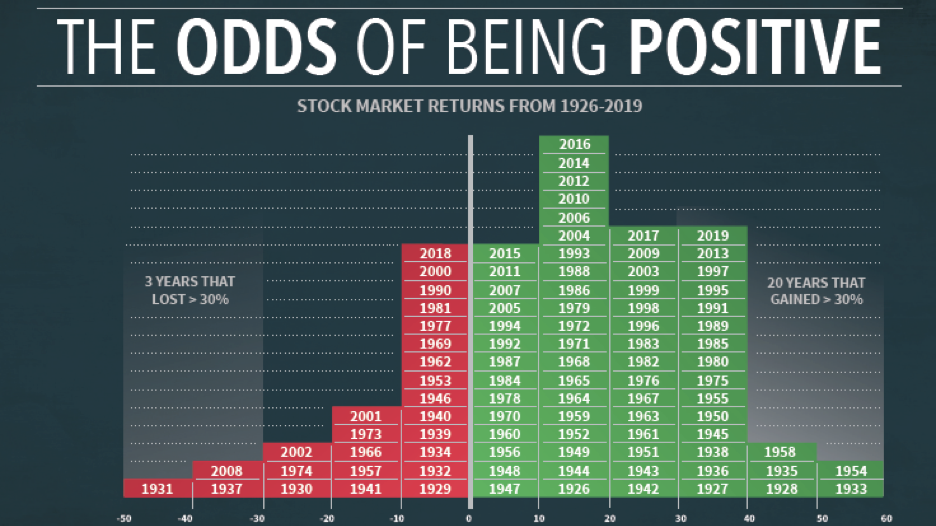

The Odds of Being Positive

When I was researching for the blog I did in October– “What do the elections mean to my investments” https://impactwealthadvisory.com/what-do-the-elections-mean-to-my-investments/#.X-QLe5NKhXg

I found the chart below, which I think is a brilliant illustration of the stock market. Can you believe how many green bricks there are compared to red over a 93-year period? Looks like we will be adding a green 2020 brick to the pile if all continues to the end of the year. It seems incredible, given what was going on in February and March of this year, that the market will most likely end in positive territory. This chart demonstrates that even though it sometimes feels scary to have your money in the market, a majority of the time you will have a positive return, if you are patient and do not panic when the market is dropping. Trust me, I know this is hard to do but that’s why you have me to hold your hand.

The U.S. stock market is represented by the S&P 500, and assumes the reinvestment of dividends. The S&P 500 is unmanaged and does not incur fees. Past performance is no guarantee of future results. Exclusive rights to this material belongs to GPS. Unauthorized use of the material is prohibited. https://www.slickcharts.com/sp500/returns

So long 2020

Even though most of us are ready to see the sun set on 2020, every crisis gives us an opportunity to learn and evaluate. It was Winston Churchill who said, “Never let a crisis go to waste” and he’s right, we can always learn something and improve from a trial. One of the ways I stayed positive during this time was by making a list of things that were possible because of Covid. Now that the year is almost over I have been reflecting on the year but most of all, I am grateful for all of the things that I had started taking for granted, like a roof over my head, good health, a loving family, being able to buy anything that I wanted at the grocery store when I wanted it, the ability to leave the house, go on vacation, fly in a plane. All of those things that a year ago I could do without a second thought. I am hoping that we can continue to make strides back to normal in the coming year.

Please do not hesitate to reach out if you would like help finishing this year or getting off to a great start next year!